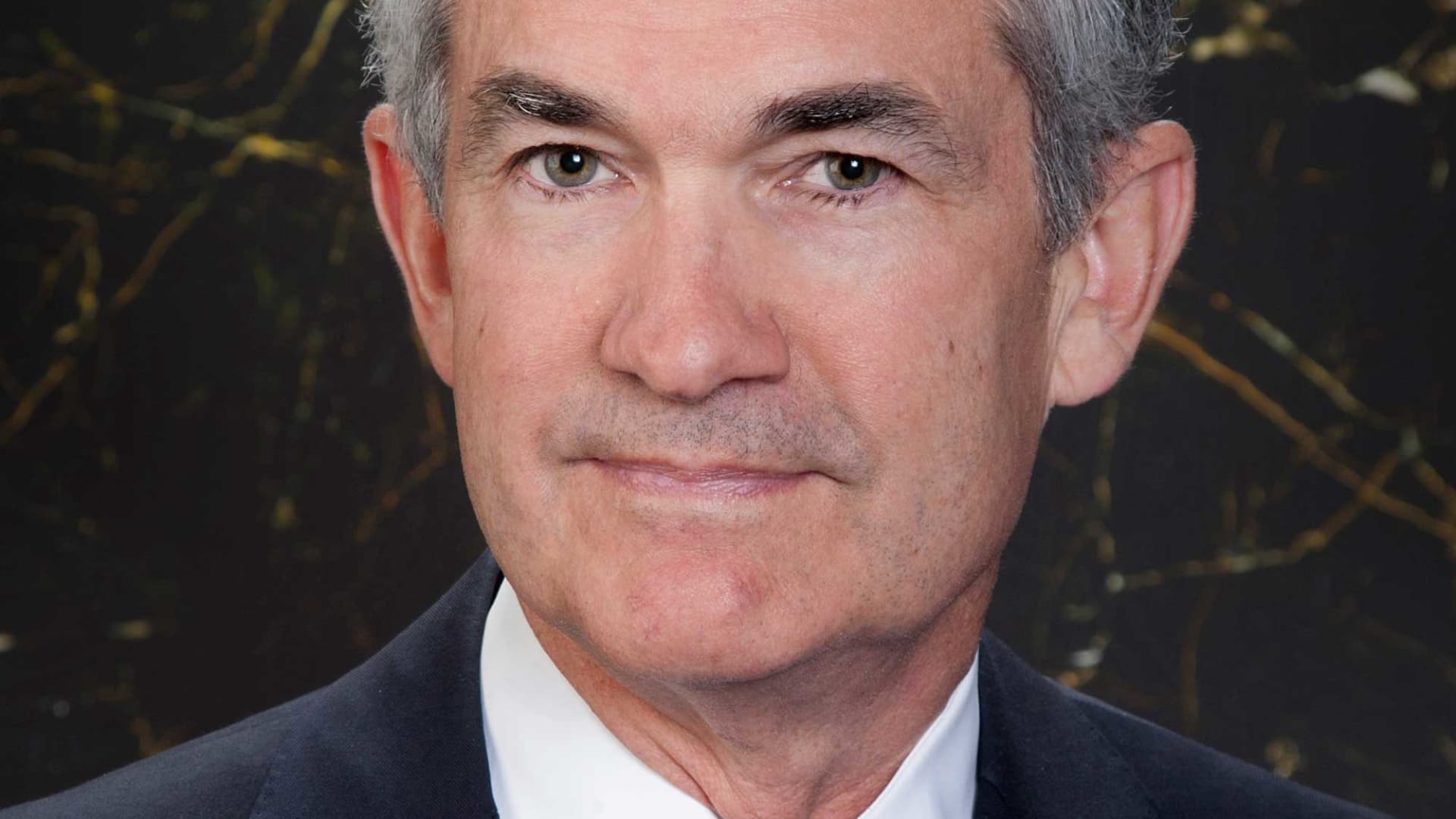

In a significant shift of gears, the Federal Reserve has announced a notable cut in interest rates by 50 basis points, marking its first such move since the onset of the Covid-19 pandemic. This aggressive adjustment aims to preemptively counteract a deceleration in the job market, delivering a clear message of concern over the economic forecast. Such a decisive action mirrors the emergency measures taken during the financial turbulence of both the Covid pandemic and the 2008 financial crisis, underscoring the seriousness with which the Fed is addressing the current economic indicators.

This interest rate reduction brings the federal funds rate to a range of 4.75%-5%, directly impacting various consumer borrowing costs, including mortgages, auto loans, and credit cards. For local residents, potential homebuyers, and business owners, this means a potential decrease in the costs of borrowing, offering a glimmer of opportunity amid growing economic uncertainties. The relevance of this cut extends beyond immediate financial relief, pointing towards a broader goal of maintaining economic stability by making borrowing more accessible to consumers and businesses alike.

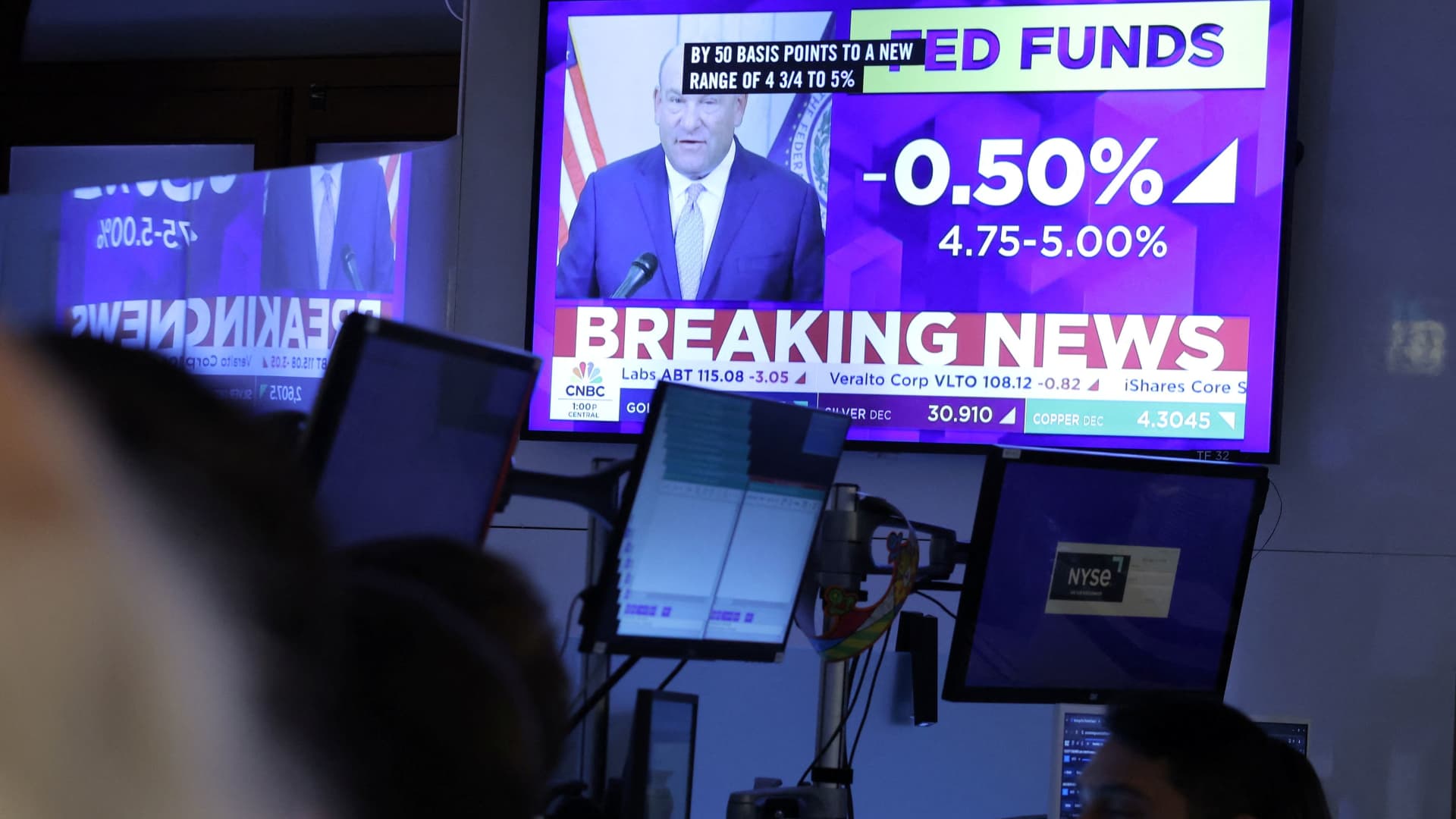

- The Federal Reserve announces a significant 50 basis points rate cut. Source: Jeff Cox – cnbc.com

The rationale behind this bold move by the Federal Reserve arises from a careful evaluation of current economic indicators. A softening in the jobs market, coupled with risings in unemployment, hints at emerging vulnerabilities within the economy. Furthermore, a gentle cooling in inflation rates suggests that previous concerns over runaway price increases may be giving way to a more balanced outlook. The decision reflects a guarded optimism that inflation is gradually aligning with the Fed’s target, highlighting an intricate balance between fostering growth and controlling price levels.

Even more intriguing for market observers is the Fed’s own projection of future interest rate cuts, as delineated in its “dot plot” forecasts. These projections anticipate further reductions by 2025, signaling a potentially prolonged period of lower borrowing costs. This forward-looking stance not only aligns with market expectations but also introduces a significant consideration for investors, who have already reacted with noticeable volatility in the stock market. The Dow Jones Industrial Average, for instance, showcased swift movements following the announcement, exemplifying the keen attention the financial markets are paying to the Fed’s policy direction.

- Jerome Powell, leading the charge with the Fed’s recent policy shift. Source: Jeff Cox – cnbc.com

The Fed’s decision to cut rates reverberates far beyond the shores of the United States, impacting the global financial landscape. Other central banks around the world, including those of England, Europe, and Canada, have similarly initiated rate cuts, reflecting a coordinated approach to countering the global economic slowdown. This collective action underscores the interconnectedness of the world’s economies, with the Fed’s policies often acting as a bellwether for global financial strategies. Moreover, the Fed’s continued quantitative tightening program, aimed at reducing its balance sheet, indicates a cautious approach to liquidity management, hinting at the complexity of navigating economic recovery paths.

Looking ahead, the Federal Reserve’s future actions remain a topic of active debate among its members, with varying opinions on the extent and speed of further rate cuts. This ongoing dialogue reflects the unpredictable nature of economic recovery, where divergent views represent a healthy deliberation over the best course of action. For our local community, this means staying informed about these developments is more crucial than ever, as they hold direct implications for mortgages, savings, investments, and business financing. As the economy navigates through these uncertain times, understanding the Fed’s policy shifts can offer valuable insights for making informed financial decisions.

- Market volatility spikes in the aftermath of the Fed’s rate cut announcement. Source: Jeff Cox – cnbc.com